Financial Sanctions – Hastening The US Economic Decline?

With the pivotal role played by the US military-industrial complex in WW II, the US displaced Britain as the dominant global economy and since then the US dollar has been the world’s dominant currency. This is consistent with the dollar’s wide international use as the most favoured reserve currency, most traded currency in foreign exchange markets and most used for trade invoicing and trade settlements. The wide use of the dollar not only gives the US companies leverage in their conduct of overseas business but also shields them from exchange rate fluctuations which can considerably enhance their risk. This enables the US economic policy – especially actions taken by the US Federal Reserve –to be the bellwether of the global economy.

Since the emergence of the US as a dominant economic and military power post-WWII, no other US foreign policy tool has been used as much as the economic sanctions. Economic sanctions continue to remain a vital tool in the US relations with Russia, China, North Korea, Iran, Afghanistan, Venezuela etc. The sanctions in addition to economic measures include travel restrictions (such as denial of visas, and withdrawal of flight operations to and from the states) against members of commercial entities and private individuals, as well as non-state actors such as terror groups etc affecting their participation in global trade. The economic measures generally include excluding the sanctioned states and entities from the US-controlled SWIFT- international financial transactions messaging system, freezing the dollar assets deposited in the US banks, trade embargoes, denial of foreign aid and loans, blocking Foreign Direct Investments, imposing unreasonably high tariffs to discourage trade, withdrawal of Most Favoured Nation status and negative votes in international financial institutions. Since the end of the cold war, these sanctions have only grown popular with the US with or without the concurrence of the UN. Since, in the conflict continuum, the sanctions fall somewhere midway between censure and armed hostilities, in 2020, the UN general secretary Kofi Annan described sanctions as more than verbal condemnation and less than the use of armed forces. This nonviolent nature of sanctions has made them so appealing in international relations.

Sanctions are frequently used as part of nonviolent coercive diplomacy to coerce targets away from unacceptable behaviour and restrain them from behaving in those ways in the future as well. Sanctions may also be in the form of penalties aimed at enforcing certain international norms such as nuclear non-proliferation, weapons of mass destruction, upholding human rights and acting against terror groups, thwarting drug trafficking, gun running, discouraging armed aggression and regime change[i]. In addition, there may be secondary sanctions against third parties that support or help dilute the sanctions’ effect by having significant political, commercial and trade relations with the sanctioned entity. For example, sanctions against Iran and Venezuela are aimed at key revenue sources of the state- the oil industry and the central bank and deny access to the US SWIFT system used for international transactions or deny credit from US financial markets. The sanctions against Russia are to deter it from continuing the armed conflict against Ukraine and include restrictions on the export of gas to Europe- a major source of revenue- freeze on Russian public as well as private individual assets under US and European jurisdiction and denial of export of military ordnance and ammunitions and stopping air links with Russia.

Economic Impact of Sanctions

The economic impact of the sanctions depends on the degree of integration of the target economy with the international economy and also the innovativeness of the target economy in circumventing the restrictions that accompany the sanctions. The Maduro government of Venezuela, for example, has strengthened economic ties with China and Russia in the face of U.S. sanctions[ii]. Similarly, Russia has not only used its sizeable foreign exchange reserves to support sanctioned firms but resorted to oil trade[iii] in local currencies[iv]. In addition, Russia has also focussed on creating domestic industries[v]. The US has sanctioned Chinese state-owned companies, government officials and businessmen over human rights issues in Hong Kong and Xinjiang and Chinese surveillance using commercial communication equipment[vi]. However, due to the economic heft of China, these sanctions have rather had minimal effect and in certain cases been counterproductive.

The sanctions do not affect only the target states but have an economic impact on the US too since they bar economic transactions from which US financial institutions, trading and manufacturing companies and individuals would have financially benefitted. In turn, the sanctions indirectly hurt US companies as they cede business to US competitors who are out of the ambit of these sanctions. US business groups have at various points unsuccessfully protested about the harm US sanctions cause to American manufacturers, and hurt American jobs. US sanctions also often invite tit-for-tat sanctions against the US from the target nations; for example, the Alaskan seafood industry and Washington State apple and pear producers were badly hit by Russia’s retaliatory ban on agricultural imports from the US.

There is a sharp division between US policymakers on the long-term consequences of unilateral economic US sanctions. There is one group which favours the sanctions as the least costly alternative to the use of armed forces to achieve US foreign policy goals while the other camp has expressed serious concerns about the long-term consequences of sanctions which can lead to erosion of the dollar hegemony in the global economy. This is borne out by the many initiatives by target nations and other vulnerable nations to explore and create new modes of conducting international trade reducing the dependence on the dollar. If major developing economies coalesce to conduct trade invoicing and settlements in currencies other than the dollar, the US would certainly face economic headwinds. Critics of economic sanctions also extend the logic of the Sanctions Paradox; that sanctions affect the allies more than the target nation because the target’s economy is less integrated with the US system than the ally’s and thus the ally suffers more negative consequences of the sanctions than the target underscoring their futility[vii]. Previous events also bear the ineffectiveness of the sanctions, for example, those after Iraq’s invasion of Kuwait, despite the universal international consensus that failed to coerce Saddam Hussein to withdraw. Similarly, sanctions against Iran have failed to coerce it to halt and roll back its nuclear weapons programme. One can say with sufficient certainty that most sanctioned nations devise alternate channels and ways to conduct international trade, bypassing the dollar’s involvement.

Facts and Events Predicting the Fall of the Dollar from its Perch

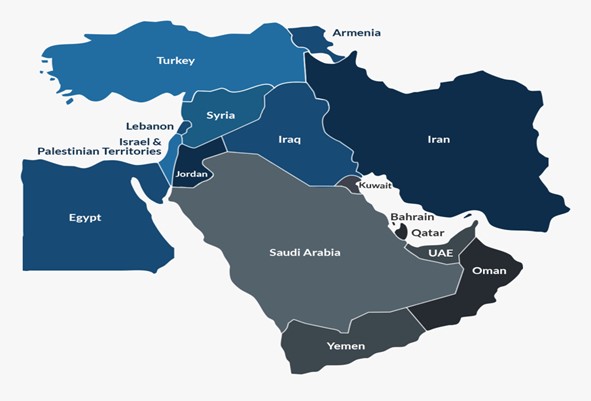

The share of US dollar assets in Central Bank reserves has witnessed a decline of 12 percentage points—from 71 to 59 per cent—since the launch of the Euro in 1999[viii] and in 2022 was 58.36 per cent. Globally the Central Banks still hold around 58 per cent of their foreign currency reserves in Dollars, but the move towards de-dollarization is evident from the many international initiatives. Malaysia has urged Asian nations to initiate the process to have a common Asian Currency[ix]; similarly, Brazil and Argentina are discussing the creation of a common currency and if it finds favour could be extended to other South American nations too[x]. India is in talks with Saudi Arabia on the Rupee trade of Oil as it has been doing with Iran[xi]. Saudi Arabia is mulling over selling oil in Yuan and other local currencies. Brazil has urged the BRICS Bank to take measures to end dependence on the dollar. The BRICS countries have also committed to reducing dependence on the dollar by trading in national currencies.

Russia and China have initiated interbank payment systems parallel to SWIFT. Both have increased gold holdings to back their currencies and initiated national currency swap agreements in several regional and bilateral arrangements where they play a role[xii].

The Eurasian Economic Union comprising Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Russia – with a population of 183 million and a combined GDP of USD 5 trillion, conducts 70% of its trade in rubles and local currencies. This saves currency exchange charges which count as significant savings. After Vietnam concluded a full trade agreement with Eurasian Union, Several Central and West Asian countries have also evinced interest in joining this grouping. Bangladesh is paying Russia in Yuan for the construction of a nuclear power plant.

By increasing trade settlements and financial transactions such as bond issuance, foreign direct investment, and bank deposits, the RMB has assumed some functions of an international currency. In some emerging market economies such as Belarus, Cambodia, Malaysia, Nigeria, Philippines, South Korea, and Russia federation it has begun to become the reserve currency and a denominated currency in bilateral currency swap agreements. RMB has over the years emerged as an international currency, albeit, on a low scale.

The members of the Shanghai Cooperation Organisation (SCO) – a prominent regional organization led by China and Russia- are deeply concerned about the vulnerability of their respective economies to the global economic domination of the dollar. At their last summit in Uzbekistan, members of the organization agreed on taking measures to expand the use of local currencies in the trade among its member states. A road map for using local currencies in trade and developing alternative payment and settlement systems has been part of the SCO’s economic plan for years[xiii].

Economists estimate that China will overtake the US to become the globe’s largest economy by 2028[xiv]. The dollar’s share of global foreign-exchange reserves is the lowest in the last two-decade, but it still exceeds all other currencies combined[xv]. Economists are ambivalent about the rise of the Renminbi as a challenger to the global domination of the dollar. This can be attributed to the proven fact that due to a history of dependence, the emergence of another economy as large as the incumbent dominant-currency issuer strengthens the incumbent dominant currency’s position at the expense of existing challenger currencies as long as it is not accompanied with shifts in global anchor currency choices and a deterioration of the incumbent’s macroeconomic stability[xvi].

Using sanctions as a political tool in a cavalier manner has significantly damaged the US standing. Sanctions produce anti-America sentiment. The initial efforts at de-dollarization of international trade could be attributed to the 2014 Western sanctions against Russia after the annexation of the Crimean Peninsula. Further toughening of sanctions against Russia after the Russia-Ukraine conflict in 2022 gave further fillip to the Russian efforts to move away from Dollar. The Rouble Yuan trade between Russia and China in the first eight months after the 2022 sanctions against Russia increased 80 times[xvii]. India is gradually increasing the convertibility of the Indian Rupee. India has in the last five years undertaken currency swap arrangements with a few nations to reduce its trade deficit but if India truly wants to insulate its economy from the volatile effects of Dollar value fluctuations it needs to develop a global network of currency swap lines.

While it doesn’t reflect the reality of a multipolar world, the US has garnered considerable economic and political clout from the dollar’s prominence in the global economy. US policy credibility, depth and liquidity of its financial markets are the macroeconomic factors which strengthen the dollar’s standing as the global reserve currency. The Chinese economy is marred by capital controls, protectionist policies and the opaqueness of policy making are often cited as reasons for shaky investor confidence. If the banking crisis and other macroeconomic policies in the US flounder, it is possible, that a basket of currencies with almost similar weightage may appear to dent the position of the dollar as the sole global reserve currency. So, is it time to write the obituary of the Bretton Woods system? Perhaps not yet, but if the global economic winds are anything to go by, it doesn’t portend well for the dollar.

*******************************************************************************************************************

References:

[i] Richard N. Haass, Economic Sanctions: Too Much of a Bad Thing, June 1, 1998, Brookings Policy Brief available at https://www.brookings.edu/research/economic-sanctions-too-much-of-a-bad-thing/

[ii] Moises Rendon, The Fabulous Five: How Foreign Actors Prop up the Maduro Regime in Venezuela, CSIS Brief 19 Oct 2020, available at https://www.csis.org/analysis/fabulous-five-how-foreign-actors-prop-maduro-regime-venezuela

[iii] Russia-India Trade Prospects in 2023 & The Emergence Of The Ruble and Rupee In Asian Trade Flows, Russia Briefing, 08 Jan 2023, available at https://www.russia-briefing.com/news/russia-india-trade-prospects-in-2023-the-emergence-of-the-ruble-and-rupee-in-asian-trade-flows.html/

[iv] India hopeful of rupee trade with Russia after imports surge, Reuters, 16 Jan 2023 available at https://www.reuters.com/world/india/india-hopeful-rupee-trade-with-russia-official-2023-01-16/

[vi] Anthony Tellez, Here Are All The U.S. Sanctions Against China, The Forbes Magazine, 28 Feb 2023, available at https://www.forbes.com/sites/anthonytellez/2023/02/08/here-are-all-the-us-sanctions-against-china/?sh=2e61bd5015b4

[vii] Lance Davis and Stanley Engerman, Sanctions: Neither War nor Peace, Journal of Economic Perspectives—Volume 17, Number 2—Spring 2003—Pages 187–197, available at https://pubs.aeaweb.org/doi/pdf/10.1257/089533003765888502

[viii] Serkan Arslanalp, Chima Simpson-Bell, US Dollar Share of Global Foreign Exchange Reserves Drops to 25-Year Low available at https://www.imf.org/en/Blogs/Articles/2021/05/05/blog-us-dollar-share-of-global-foreign-exchange-reserves-drops-to-25-year-low

[ix] Vijay Eswaran, A common currency in ASEAN will benefit citizens, The Statesman, 23 Sep 2022 available at https://www.thestatesman.com/business/a-common-currency-in-asean-will-benefit-citizens-1503116247.html

[x] Michael Stott and Lucinda Elliott, Brazil and Argentina to start preparations for a common currency, Financial Times, 22 Jan 2023 available at https://www.ft.com/content/5347d263-7f24-4966-8da4-79485d1287b4

[xi] India initiates talks with Saudi Arabia for rupee-riyal trade, The Hindustan Times, 20 Sep 2022 available at https://www.hindustantimes.com/india-news/india-initiates-talks-with-saudi-arabia-for-rupee-riyal-trade-101663613007448.html

[xii] In 2017, Ruble-Yuan ‘payment versus payment’ started along the BRI. In 2019, the two countries switched to the Yuan RMB and Ruble exchange for their USD 25 billion trade.

[xiii] Zongyuan Zoe Liu, China Is Quietly Trying to Dethrone the Dollar, Foreign Policy, 21 Sep 2022

[xiv] Shehnaz Ahmed, Could China’s digital renminbi pose the US dollar a challenge? The Mint, 28 Apr 2021 available at https://www.livemint.com/opinion/online-views/could-china-s-digital-renminbi-pose-the-us-dollar-a-challenge-11619555545449.html

[xv] Serkan Arslanalp, Barry Eichengreen , Chima Simpson-Bell, Dollar Dominance and the Rise of Nontraditional Reserve Currencies , Cahrt of the Week, 21 Jun 2022, available at https://www.imf.org/en/Blogs/Articles/2022/06/01/blog-dollar-dominance-and-the-rise-of-nontraditional-reserve-currencies

[xvi] Georgios Georgiadis, Helena Le Mezo, Arnaud Mehl, Cedric Tille, Fundamentals vs. policies: can the US dollar’s dominance in global trade be dented? European Central Bank Working Papers, available at https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2574~664b8e9249.en.pdf

[xvii] Bruno Vendetti, De-Dollarization: Countries Seeking Alternatives to the U.S. Dollar, available at https://www.visualcapitalist.com/de-dollarization-countries-seeking-alternatives-to-the-u-s-dollar/

Disclaimer

The opinions expressed in this article are the author’s own and do not reflect the views of Chanakya Forum. All information provided in this article including timeliness, completeness, accuracy, suitability or validity of information referenced therein, is the sole responsibility of the author. www.chanakyaforum.com does not assume any responsibility for the same.

Chanakya Forum is now on . Click here to join our channel (@ChanakyaForum) and stay updated with the latest headlines and articles.

Important

We work round the clock to bring you the finest articles and updates from around the world. There is a team that works tirelessly to ensure that you have a seamless reading experience. But all this costs money. Please support us so that we keep doing what we do best. Happy Reading

Support Us

POST COMMENTS (5)

Prof Rizwan

Rajeev Yadav

Deepak Talwar

Vivek Sharma

Om Misra