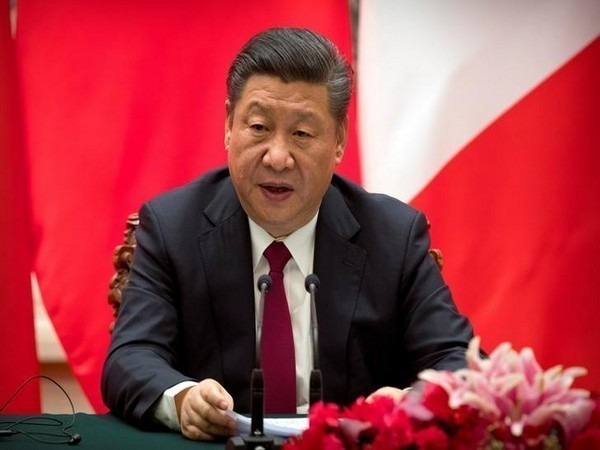

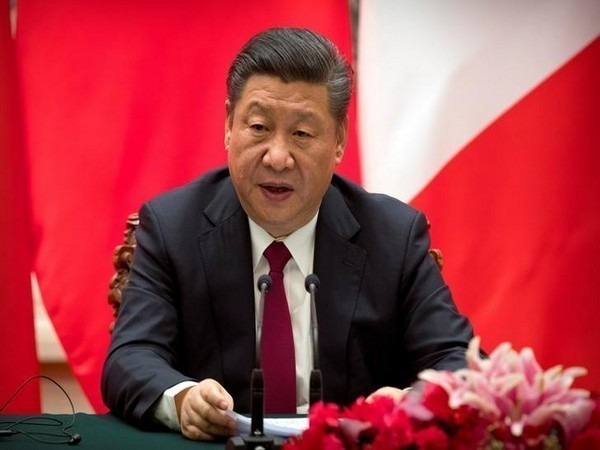

Xi’s crackdown on big tech hampers China’s global call

Taipei [Taiwan], August 7 (ANI): Chinese President Xi Jinping’s recent crackdown on big tech and private firms to resolve internal uproars have now resulted in a drastic financial fall. And the recent crackdowns have also sent signals to global big tech firms that are based out of China.

Xi Jinping’s harsh and crude tactics employed to deal with internal political problems have broadly affected the domestic element of the strategy and increased risk in China’s financial system, which has spread to stock markets in Hong Kong and New York, Taipei Times said on Saturday.

China’s recent policy shift toward tech monopolies has either forced them to drastically scale back their business operations or swallow enormous fines. As a result, e-commerce giant Alibaba Group’s share price has sunk 35 percent so far this year, vaporizing almost US$300 billion from the company’s total market capitalization.

Alibaba’s competitors were not spared either; Tencent Holdings’ share price has dropped 33 percent, while Baidu and JD.com have seen their share prices drop by 30 percent, Taipei Times added.

Last year, when Chinese billionaire Jack Ma had criticised the country’s financial regulators and state-controlled banks, Beijing started targeting the businessman and regulators pulled a highly anticipated IPO for his company Ant Group, the financial affiliate of Ali baba.

Earlier, when the US had sanctioned many Chinese firms for certain reasons, Beijing had vowed to protect Chinese corporate interests. But despite promoting, the communist regime had been targeting the big firms that resulted in the massive downfall of the companies’ benefits and warned global tech giants of the communist regime’s possible future actions. (ANI)

POST COMMENTS (1)

Aman