India’s Rising Defence Exports – Can India Be A Major Arms Exporter?

The official declaration of India’s defence exports in 2021-22 to be at an all-time high of Rs 15,920 crores marks a watershed in a sector that was traditionally viewed as a slow and cumbersome process where the alignment of India’s potential with its actualisation was mismatched. Hailing this achievement as a “clear manifestation of India’s talent and enthusiasm towards ‘Make in India’ (where) the reforms in this sector over the last few years are delivering good results,” Prime Minister Modi stated the Government’s clear intent to make India a defence production hub. The challenge is to sustain the trajectory of growth going forward. This article seeks to suggest some pointers in this direction.

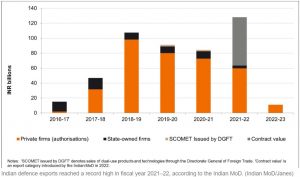

As an outcome of several consistent policy initiatives, India today exports arms to 85 countries. While India’s defence and aerospace exports in 2022-23 registered a 24% increase over the achievement of Rs 12,814 crores in 2021-22, there is some distance (54%) to be covered if the stated objectives of achieving the defence export target of Rs 35,000 crores by 2025 is to be realised. From the global perspective, India still does not figure in the top 25 countries which export defence products although the surge in exports is over tenfold when compared to 2016-17.

Significantly, exports from India now account for a wide range of platforms and weapon systems, ranging from the HAL manufactured Dornier 228 aircraft to Brahmos and Akash missiles, Pinaka rockets and launchers. The exports include the Advanced Towed Artillery Guns or ATAGS, mine protected and armoured vehicles apart from bullet proof body armour, thermal imagers, small arms and ammunition. With production at the Amethi based AK 203 rifle factory now commencing, it is expected that exports over a period of time will commence in this segment. The potential for HAL’s light combat aircraft Tejas apart from its light combat helicopters augurs well for the sector. Shipyards and private sector capacity in the maritime domain also have the potential to enter the sector given India’s strategic location in the Indian Ocean region and its position in the ASEAN. The sector has gained in strength under the direction provided by the Raksha Mantri.

Although defence exports have carved out a spectacular growth, it is important to consider whether this has been a joint story of the public and the private sectors. The share of defence production, as per Ministry of Defence data, is revealing: Defence Public Sector Undertakings (DPSUs) account for 57%, the (erstwhile) Ordnance Factories Board (OFB) for 16%, other PSUs/Joint Ventures for 6% and companies in the private sector for 21%. With the several policy initiatives, this split will likely change. However, greater thrust is needed. More hand holding and support in testing, standardisation and conformance are imperative. It is important for the Government to consider appointing a full-time Secretary Defence Production in order to give the policy initiatives for defence exports to take centre-stage. It makes for poor optics when a key wing of the Ministry of Defence remains without a Secretary to drive the Atmanirbhar Bharat initiative. It also does not help if three key Defence PSUs such as Hindustan Aeronautics Ltd. (HAL), Bharat Electronics Ltd. (BEL) and Mazagon Docks Ltd. (MDL) remain without Chief Executives.

Source: Janes Defence July 2022

The defence export sector will need to remain nimble and adaptive to the changing requirements of the market. There are several opportunities for this. The i-DeX initiative and the start-up eco-system will be the natural drivers for this apart from the traditional and legacy arms and ammunition manufacturers. The manufacture and export of drones in a reasonably short period of time by Turkey to Azerbaijan/Armenia not too long ago is a case in point. Whilst domestic requirements will remain and continue to receive priority, there is a need to identify markets and devise a strategy to push the exports of such products to countries that are defence partners/strategic partners. This will ensure that the marketing strategy is conducive in terms of product, technology transfer and end-use governed by necessary agreements to ensure safeguards.

There is a need to shift the focus of defence exports from products to services as well. In the aerospace sector, Maintenance-Repairs-Overhaul (MRO) is one such sector that can be considered, given the fact that India now boasts of technical expertise in design, manufacture and maintenance of a fairly diverse fleet of aircraft and rotary lift capacities. It is also important that the efforts of the innovators and start up community is given a direction and quality and certification labs opened to private industry engaged in exports through accredited laboratories. The online portal of the Department of Defence Production today disseminates export enquiries from different countries to registered defence exporters on a real time basis. This facilitates them to respond to queries on a real time basis.

An approach to link up the manufacturing initiative with the opportunities offered by the Offsets regime has commenced. The policy of 2006 included fostering development of internationally competitive enterprises, augmenting capacity for research, design and development in defence products and services apart from encouraging the development of civil aerospace and internal security. Amendments in July 2020 deleted services, civil aerospace and internal security sectors shifting the focus to manufacturing. This was in recognition of the need to recalibrate offsets discharge of only 1.68 bn USD obligations against the 3.60 bn USD required in the 54 contracts signed. The new offset policy includes multipliers to facilitate technology transfer, attract FDI and promote export of finished products through higher multipliers of 2, 3 and 4 for investment and technology transfer and not merely parts and components have been introduced. The duration of discharge of obligations has been modified to two years beyond the end of the main contract, excluding the warranty period. Fulfilment of offset discharge by entities other than the main offset provider and its Tier I sub-vendors has also been allowed to enable subsidiaries/sister companies to fulfil discharge obligations on their behalf. ‘Banking’ of offsets, introduced in 2008 has been discontinued. Inclusion of MSMEs in the multipliers has been done with similar incentives for the two Industrial Corridors announced in 2017. Greater transparency and accountability of the government through an on-line process for reporting and monitoring of offset discharges have been introduced. The challenge is to integrate these with the defence manufacturing ecosystem focussed on exports.

Given that the nature of defence acquisitions by countries has its strategic concerns at the core, defence exports ride not merely on technology and reliability of the weapons/weapon systems, but also on foreign policy. India’s muscularity in this direction has played a major role in the growth of defence exports, not merely through Line of Credit assistance to countries in our own strategic neighbourhood but also as part of a robust “Act East” policy as well as a focus on Africa and South America. A pro-active projection of export potential across Friendly Foreign Countries (FFCs) will help. Webinars must be followed up with composite delegations and export promotion meets. It is expected that this push will continue to drive exports in the defence and aerospace sector.

The growth of Indian defence exports has been facilitated by a more proactive approach. The inclusion of Defence Attaches in India’s missions abroad and the creation of export facilitation cells manned by officials from the DPSUs commenced since 2018. This approach needs to be strengthened to become broad-based and inclusive to provide for greater synergy through supporting the private sector also. Having organised 12 editions of DefExpo and 14 of Aero India, the Defence Exhibition Organisation (DEO) now needs to transform into a more professional export support wing of the Department of Defence Production. A Defence Export Promotion Corporation with the DEO as an outreach vertical, with a mandate and presence on the lines of an export body based in identified locations across the globe, is an idea whose time has come. Linkages with organisations such as Invest India and the defence and aerospace wing of industry bodies like Confederation of Indian Industry will help too. A beginning has been made with the concept of an ‘India Pavilion’ in defence exhibitions in order to showcase the capabilities of the sector holistically, both public and private. This must now strategically concentrate on the overseas markets.

Currently, defence export regulation is done by the Director General of Foreign Trade (DGFT) which grants licenses for items falling in the SCOMET List under the Foreign Trade Policy. Export licenses are granted by DGFT after examination by the inter-Ministerial Working Group under it. The Department of Defence Production issues No Objection Certificates (NOCs). End User Certificates (EUCs) are also required for ‘in principle’ clearances to industry. Licensing for defence exports needs to be placed on a more facilitative mode. This function continues to be under the domain of the Ministry of Home Affairs. If markets are to be tapped and orders secured, this aspect of ‘ease of doing business’ for defence exporters would require to be streamlined with time-lines that ensure shortened response and delivery periods based upon stakeholder consultation. The three Open General Export Licences (OGEL) notified by Government for export of Parts and Components, Transfer of Technology and Major Platforms and Equipment is a step in the right direction. Under this dispensation, industry is permitted to export specified items to specific destinations as per the OGEL. Standard Operating Procedures (SOPs) to bring in greater transparency and focus on exports must be notified soon.

It is too early to assess the gains of corporatisation of the Ordnance Factories. However, this bold decision of government needs to be closely followed up to enable a quick transition from licensed production to technology led growth. This will require stepping up of expenditure on R&D by the units created and creating a large vendor base, which is around 5000 currently, despite the existence of 11 Ordnance Development Centres.

The Government’s stated Strategy for Defence Exports in its Annual Report clearly enunciates that defence industrial policy has to be supplemented by a strategy for defence exports. The Defence Production Policy, 2011 also places the defence export strategy within the framework of the overarching Foreign Trade Policy (FTP) of the Ministry of Commerce and Industry. It also contemplates a specific export promotion/facilitation body in association with industry to be guided by a Defence Export Steering Committee under the Secretary, Defence Production. With the growing maturation of policy initiatives, it would be useful to consider formalisation of an approach through a time bound road map. Government should consider an inter-Ministerial Group to come up with suggestions. The momentum needs to be nurtured, lest it dissipates.

Disclaimer

The opinions expressed in this article are the author’s own and do not reflect the views of Chanakya Forum. All information provided in this article including timeliness, completeness, accuracy, suitability or validity of information referenced therein, is the sole responsibility of the author. www.chanakyaforum.com does not assume any responsibility for the same.

Chanakya Forum is now on . Click here to join our channel (@ChanakyaForum) and stay updated with the latest headlines and articles.

Important

We work round the clock to bring you the finest articles and updates from around the world. There is a team that works tirelessly to ensure that you have a seamless reading experience. But all this costs money. Please support us so that we keep doing what we do best. Happy Reading

Support Us

POST COMMENTS (1)

Kalidan Singh