Cash-strapped Pakistan, IMF agree to extend stalled bailout package, increase loan size to USD 8 bn

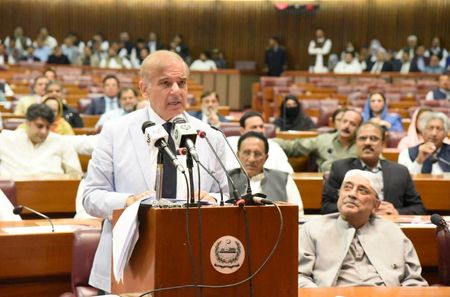

Islamabad, Apr 24 (PTI) Cash-strapped Pakistan and the IMF have agreed to extend the stalled bailout package by up to one year and increase the loan size to USD 8 billion, giving a breathing space to the new government led by Prime Minister Shehbaz Sharif, a media report said on Sunday.

The understanding was reached after the crucial talks between Pakistan’s newly-appointed Finance Minister Miftah Ismail and IMF Deputy Managing Director Antoinette Sayeh in Washington, The Express Tribune reported, citing sources. Subject to the final modalities, the International Monetary Fund (IMF) has agreed that the program will be extended by another nine months to one year as against the original end-period of September 2022, while the size of the loan would be increased from the existing USD 6 billion to USD 8 billion, the paper reported, citing sources.

The IMF is expected to issue a statement on Monday on the development. Minister of State for Finance Dr Aisha Ghaus Pasha, outgoing State Bank Governor Dr Reza Baqir, Finance Secretary Hamid Yaqoob Sheikh and Pakistan’s Executive Director to the World Bank Naveed Kamran Baloch also participated in the meeting with the IMF team.

Ismail was in Washington to renegotiate the USD 6 billion bailout package that was stalled by the previous Imran Khan regime. The Pakistan Tehreek-e-Insaf government and the IMF had signed a 39-month Extended Fund Facility (July 2019 to September 2022) with a total value of USD 6 billion. However, the previous government failed to fulfil its commitments and the program remained stalled for most of the time as USD 3 billion remained undisbursed.

Before taking Pakistan’s case to the IMF Board for approval, Islamabad would have to agree on the budget strategy for the next fiscal year 2022-23, the sources said. Also, the government of Prime Minister Sharif would have to demonstrate that it would undo some wrong steps taken by the former regime against the commitments that it gave to the IMF Board in January this year.

Cash-strapped Pakistan is passing through a phase of political and economic uncertainty and the decision to stay in the IMF program for longer than the original period would bring clarity in economic policies and soothe the rattling markets. The release of the fund would be a welcome antidote for the country’s sagging economy that is staring at plummeting forex reserves (USD 10.8 billion) and a current account deficit crisis.

To give a final shape to the extended program, an IMF mission would visit Pakistan likely from May 10, the sources said, adding that the IMF team will be led by its new mission chief, Nathan Porter. On the successful conclusion of talks, it was expected that both sides would reach a staff-level agreement, a senior finance ministry official said.

The technical staff of Pakistan and the IMF would start engagement from Monday to see the budget position in light of the “irresponsible” decisions made by the previous government. However, before formally securing the IMF approval for increasing the program size and the cash limit, the government will have to show that it is sincere in making the needed tough policy decisions.

The sources said the IMF had asked Pakistan to withdraw fuel and electricity subsidies that former premier Khan had announced on February 28 in “total disregard for fiscal prudence” and to “gain the lost support” due to double-digit inflation in the country. Finance Minister Ismail has said last week that the government was giving Rs21 per litre subsidy on petrol and Rs51.54 per litre on high-speed diesel that in the month of April alone would cost the taxpayers Rs68 billion. These subsidies would have to be withdrawn to revive the program.

The newly-formed Shehbaz Sharif government that took over this month also has to deal with spiralling inflation and an economy that simply refuses to rebound. In its latest report on Pakistan, IMF has predicted an annual growth of 4 per cent, against the country’s central bank’s estimates of around 4.8 per cent. On Wednesday, Ismail in his first press conference as the country’s finance minister said that the IMF had put forward a list of demands for the revival of the bailout package to be implemented.

These include withdrawal of fuel subsidy, banishing the tax amnesty scheme, increasing power tariff and imposing additional taxation measures. The subsidies on fuel and power were implemented by Khan, days before he was ousted from power. A rollback would be an arduous task for the present government, especially at a time when Pakistan’s consumer inflation clocked at 12.7 per cent for the month of March.

In Washington, Ismail also held meeting with the World Bank managing director and the two sides discussed the possibility of unlocking about USD 1.8 billion WB lending that too had stuck up because of either lack of fulfillment of actions promised by the last government or because of the bureaucratic snags, the sources added.

After his meetings in Washington, Ismail will be travelling to London to meet Pakistan Muslim League-Nawaz (PML-N) supremo Nawaz Sharif.

POST COMMENTS (0)