World Economic Outlook by IMF: Forecast of India’s Growth Rate at an optimistic 12.5% in 2021, highest among all countries

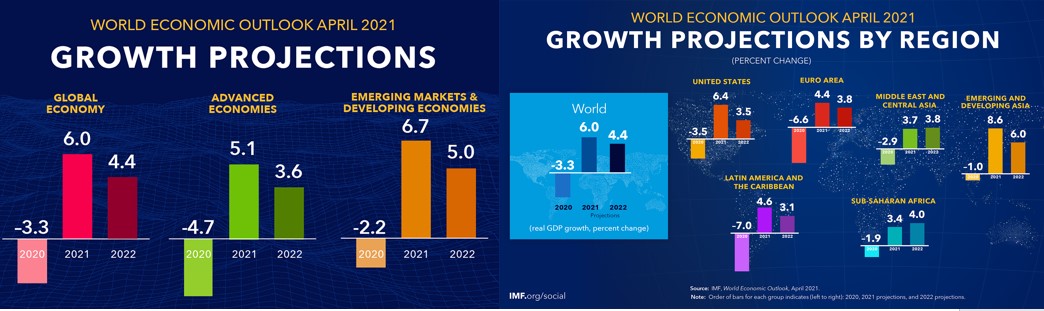

International Monetary Fund expects global economy to be on firmer ground, but the predicts a large gaps among nations with divergent recoveries amid high uncertainty. The behaviour of economies will greatly vary due to differences in access to vaccines and uneven recoveries which will mean that different countries may remain in different phases for some time. IMF Chief Ms Kristalina Georgieva tweeted, “Our growth projection of 6% shows the global economy is on a firmer footing. But we are seeing a multi-speed recovery around the world, with too many countries and people at risk of falling behind.” The IMF today said that they are projecting a stronger recovery compared with its January forecast, with growth projected to be 6% in 2021, after an estimated historic contraction of -3.3% in 2020.

The World Economic Outlook report mentions that the global growth is expected to moderate to 4.4 percent in 2022. The projections for 2021 and 2022 are stronger than in the October 2020 WEO. The upward revision reflects additional fiscal support in a few large economies, the anticipated vaccine-powered recovery in the second half of 2021, and continued adaptation of economic activity to subdued mobility. High uncertainty surrounds this outlook, related to the path of the pandemic, the effectiveness of policy support to provide a bridge to vaccine-powered normalization, and the evolution of financial conditions.

Courtsey: www.imf.org

In its report, IMF predicts a higher growth rate for India in 2021, pegging it now at 12.5%, an upward revision from its earlier estimate. It is ahead of China’s predicted growth of 8.4% in 2021 and will stay ahead of China in 2002 as well at 6% viz-a-viz 5.6%. The positive outlook for Indian economy amidst the second wave of pandemic in the country is a matter of cheer for the Modi Government and an endorsement of its economic policies as well as management of Covid 19.

In her blog on 06 April titled “Managing Divergent Recoveries”, Ms Gita Gopinath, Chief Economist of the IMF writes, “The upgrades in global growth for 2021 and 2022 are mainly due to upgrades for advanced economies, particularly to a sizeable upgrade for the United States (1.3 percentage points) that is expected to grow at 6.4 percent this year. This makes the United States the only large economy projected to surpass the level of GDP it was forecast to have in 2022 in the absence of this pandemic. Other advanced economies, including the euro area, will also rebound this year but at a slower pace. Among emerging markets and developing economies, China is projected to grow this year at 8.4 percent. While China’s economy had already returned to pre-pandemic GDP in 2020, many other countries are not expected to do so until 2023.” What is likely to be an oblique reference to India, she says, “Swift policy action worldwide, including $16 trillion in fiscal support, prevented far worse outcomes. Our estimates suggest last year’s severe collapse could have been three times worse had it not been for such support.”

Indian policy makers deserve a pat as their approach has been in line with what has been mentioned in the current report of IMF where it emphasizes that while the pandemic continues, policies should first focus on escaping the crisis, prioritizing health care spending, providing

well-targeted fiscal support, and maintaining accommodative monetary policy while monitoring financial stability risks. Then, as the recovery progresses, policymakers will need to limit long-term economic scarring with an eye toward boosting productive capacity (for

example, public investment) and increasing incentives for an efficient allocation of productive resources.

POST COMMENTS (0)