India’s Lithium Resource: A Perspective

Global economy has been dealt tandem blows by the Pandemic and Ukraine crisis. The world is now in the grip of a major fuel, food and fertilizer crisis, rising interest rates, high inflation and subdued growth. Manufacturing industries across the world are struggling with supply chain bottlenecks. Globalisation has been put under severe strain. Unilateral sanctions have made the situation even worse, especially for the global south. Amidst all this gloom, India remains a beacon and a pillar of hope for global economic revival.

It is in this backdrop, that India’s Ministry of Mining, on February 9, 2023, announced a 5.9 million metric ton “Inferred Lithium Resource” in the Salal-Haimana belt of Riasi in Jammu & Kashmir. The possibility and significance of a domestic Lithium source and the excitement that the announcement generated calls for a closer look at the reported Lithium deposit as well as the overall Indian mineral scenario.

Lithium is the “Energy metal of the 21st Century”. Battery, as the key storage source, is crucial to green energy. Lithium-ion is the most viable option for battery applications due to its comparative safety, stability, cost and higher energy density. Compared to Lead-acid batteries which provide an energy density of 50-100 Wh/kg, today’s Lithium-ion batteries provide 200 to 300 Wh/kg of energy density.

Till as recently as 2015, the battery segment accounted for less than 30% of the Lithium demand, with ceramics and glasses accounting for 35%. Greases, metallurgical powders, polymers and other industrial applications accounted for another 35%. This pattern is undergoing a total shake-up and by 2030, batteries are set to account for about 95% of Lithium demand. Just as there is no alternative to the use of Rare Earth Elements at present for making powerful, miniature permanent magnets so critical for efficient motors in electric vehicles, wind turbines and electronic industry, there is no known substitute to Lithium for meeting the energy storage requirements of the mobility sector and modern electronic industries.

The shift to cleaner energy and the global rush to achieve net zero carbon emission is entirely dependent upon resilient and secure supply chains of minerals like Copper, Lithium, Rare Earths, Nickel and Cobalt.

Lithium is central to all types of traction batteries in electric vehicles as well as consumer electronics. As per an April 2022 Mckinsey & Company report, Electric vehicles sales grew by 50% in 2020 and doubled to about 7 million units in 2021. Global demand for Lithium Carbonate equivalent is estimated to increase from 500,000 metric tons in 2021to 3 to 4 million metric tons by 2030. Investment in Lithium exploration has kept pace with the jump in demand and has increased by almost 50 times in less than a decade. Despite all this, the projected Lithium supplies is estimated to touch only about 2.7 million tons by 2030 which could cause a significant demand-supply gap. Lithium prices witnessed a five fold increase in 2021 and by early 2022, cost of Lithium Hydroxide and Lithium carbonate had gone up from a $14,500 per metric ton to about $65,000 – $75,000 per metric ton.

Roughly 90% of the global Lithium production comes from Australia, Chile and China. Australia contributes about 52%, Chile 25% and China about 12 to 13%. As far as global Lithium reserves are concerned, the largest share of about 9.3 million metric tons (Mt) is found in Chile, followed by Australia with 3.8 Mt, Argentina 2.7 Mt, China 2.0 Mt and US 1.0 Mt. According to Bloomberg NEF, China controls 80% of the world’s Lithium refining and 77% of the world’s battery cell capacity. It is interesting to note that about 12 Kg of Lithium goes into the battery of a Tesla’s model ’S’ car.

India imported Lithium worth $22 million in 2021-22, sourced mainly from Hong kong, China and US. In addition, during the same year, the country imported Lithium-ion batteries worth $1832 million. The steep increase in demand for Lithium and Lithium-ion batteries in the years ahead can be visualised from NITI Aayog’s assessment that EV vehicles in India will go up to 80 million units by 2030 from the one million mark of 2022.

Every industry and manufacturing activity is dependent upon assured supply of inputs and raw materials. High import dependency for inputs implies high risk and creates vulnerability. Japanese were given a measure of their raw material vulnerability by China when it temporarily stopped Rare Earths supply to it in 2010. Closer home, in early 2021, India witnessed a brief tightening of Covid vaccine raw material supply by United States. Industries across the world are now also realising the pains of dependency on just a handful of sources for semiconductors.

India has made known its aspiration to become a developed nation by 2047. It has embarked on an ambitious Atmanirbhar journey with the clear objective of becoming a major global manufacturing hub. Today, India’s manufacturing sector accounts for about 17% of the nation’s GDP employing over 27 million workers. The sector is estimated to attain an export capacity worth $1 trillion by 2030 taking it’s GDP share to 25%.

During 2020-2021, India’s domestic mineral production was valued at Rs 1,11,133 crores while it imported minerals (excluding coal) worth Rs 4,24,705 crores, leaving a yawning gap. Today, minerals excluding petroleum and natural gas contributes an abysmally low 1.69% to India’s GDP. This is in stark contrast with South Africa and Australia which share geological similarities with Indian subcontinent. Minerals contribute over 8% to their GDP. These figures are indicative of India’s huge untapped potential for mineral mining.

As per Ernst & Young, India’s GDP is set to reach $7 trillion by 2030 and soar to $26 trillion by 2047 with a per capita GDP of $15,000. Indian manufacturing sector will also witness corresponding huge leaps. In the absence of transformational measures to identify and exploit domestic resources and raw materials, India’s import dependency for critical and strategic minerals may reach a level where it could threaten our national security. NITI Aayog cautions that India could face challenges even to meet its increasing demand for thermal coal and iron ore. India’s share in the global energy consumption is set to rise from 7% to 14% by 2050. IEA predicts India will account for 25% of global energy demand growth from 2020 to 2040. The country’s growing appetite for energy is set to increase its thermal coal import to 243 million tons by 2030. National Steel Policy 2017 projects India’s per capita steel consumption to go up from 61 Kg to 158 kg by 2030 and India will need to double its iron ore mining capacity by 2030 to meet this requirement.

India confronts a huge challenge in the context of carbon emission. In PPP terms, India’s per capita income is just about 40% of the average global per capita income. As a result, the country’s per capita energy consumption and per capita carbon emission are also very low at about 25% to 30% of the global per capita average. These figures are indicative of the huge strides that India needs to take in terms of development which will translate into corresponding huge jumps in the country’s energy consumption and carbon emissions. What is of concern is that, because of India’s population size, even with today’s abysmally low per capita carbon emission, India’s gross carbon emission is the third highest in the world behind only US and China. It is evident that, for India, ‘low carbon-footprint growth’ is an imperative and more critical than for any other country in the world. The challenge becomes all the more daunting when we consider our ambitious target of net zero emissions by 2070.

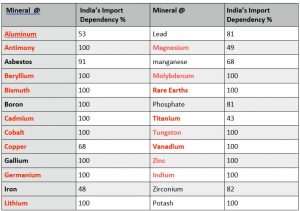

Considering the geopolitical trends, it is evident that India must prepare itself to overcome stiff headwinds, intense competition and denial of raw materials by competitors and adversaries. There is thus, a clear need to identify factors such as high import dependency of critical raw materials and inputs which could pose crippling risks to India’s growth in addition to making every effort to exploit the unexploited / underexploited segments which offer big growth potential. India’s fast track and focused action on domestic manufacturing of semiconductors and active pharmaceutical ingredients are very encouraging green-shoot initiatives in this regard. Critical minerals is another segment which merits concerted and urgent attention. India has near total import dependency for critical minerals which are extremely essential for green energy as well as strategic and hi-tech sectors such as aerospace, green-tech, telecom and IT industries. Economic survey 2022-23 amply highlights this aspect.

In the context of critical minerals, a study carried out for the Department of Science and Technology in 2016 by The Council on Energy, Environment & Water (CEEW) clearly brings out the challenges ahead for India. The study identified minerals which are likely to pose supply risk to India by 2030, based on their economic value, significance in the manufacturing sector and availability. Some of the important minerals placed in the ‘high supply risk category by 2030’ for India by the study are listed in the table below.

(@ – Minerals shown in red are classified as strategic minerals based on their criticality in aerospace and defence industries)

Depending upon their pattern of occurrence, minerals are loosely referred to as ‘surficial’ or ‘deep-seated’. Deposits close to the earth’s surface or at shallow depths are referred to as ‘surficial’ deposits. Examples are iron ore, bauxite, limestone, dolomite, manganese, chrome, etc. Deep-seated deposits, as the name suggests, are those found buried deep under the earth’s surface. Minerals that are generally found deep-seated are gold, lead, zinc, copper, nickel, PGMs, diamond, Rare Earths etc. This categorisation is based on the general pattern of occurrence and there are exceptions. Most high value minerals are found deep-seated. Discovering mineral deposits, especially the deep-seated minerals and extracting them economically requires great deal of effort and skill. Even for the same mineral, the technique/process used for mineral extraction varies from mine to mine depending upon the type of deposit.

Mineral exploration is a systematic and long drawn out process. Stages of mineral exploration are graded from G4 to G1. At the lowest end of the spectrum is the G4 or the ‘reconnaissance stage’. At the other end of the spectrum is the G1 stage which is the advanced, final stage, where very accurate details of the location and dimensions, quantity, extraction process, the economic viability of the deposit etc are established.

The G4 stage is followed by the G3 stage which involves prospecting process to narrow down the areas of enhanced mineral potential. G3 stage exploration upgrades the deposit to what is referred to as the ‘inferred mineral resource stage’. In the next stage i.e., the G2 stage, general exploration is carried out with the objective of identification and initial delineation of the identified deposit which upgrades the deposit to ‘indicated mineral resource stage’. This is followed by detailed exploration in the G1 stage wherein three dimensional delineation of identified deposits are carried out to establish the deposit’s size, shape, structure, grade and other relevant characteristics with a high degree of accuracy. G1 stage upgrades the deposit to ‘measured mineral resource stage’. The process from G4 to G1 may take anything from 8 to 10 years or even much longer. It is possible that at any stage during exploration from G4 to G1 stage, a deposit may be found to be unviable in terms of process or economic viability. It is only after the exploration process proceeds beyond the G2 stage and the economically mineable part of the deposit is assessed with a high level of confidence, that a deposit or resource is considered as a mineral ‘reserve’. The terms mineral ‘resource’ and mineral ‘reserves’ are thus clearly delineated and have vastly different connotations. They cannot be used interchangeably. Also, the Indian mineral Industry code for reporting exploration results lays down that an ‘Inferred Resource’, due to its lower level of confidence cannot be considered as a Mineral ‘Reserve’.

In the context of the Lithium findings in the Salal-Haimana belt, Dr Amit Tripathi, Director, MPXG Exploration, a renowned mineral exploration professional, explains that most supplies of lithium in the world comes in the form of saline groundwater enriched in dissolved Lithium referred to as brines. The brine is pumped to the surface and concentrated by natural evaporation for anything upto a couple of years to enhance the metal content to 2-6%. Thereafter, it is processed in chemical plants to obtain Lithium carbonate and lithium metal. The second type of lithium occurrence is in hard rocks such as pegmatites with high concentrations of Lithium-bearing minerals. The concentration of Lithium required for extraction from hard rock occurrences to be viable is much higher than in brine occurrence.

As per official announcement, the current status of the Lithium occurrence of Salal-Haimana, is “inferred resource”. This deposit, which is in the form of Bauxite crust, was first reported in 1999 by the Geological Survey of India. The Bauxite crust occurrence is geologically different from the two commonly found occurrences i.e., brine or hard rock formation. Dr Tripathi explains that details such as grade distribution and geological continuity of the Salal-Haimana occurrence are yet to be determined and will take major investment as well as extensive drilling and exploration effort. He also points out that as the nature of occurrence in this case is different from the two commonly found occurrences, there will be a need to develop an economically viable recovery technology, specific to this type of occurrence.

The reported Lithium deposit at Salal-Haimana holds out huge promise for India. However, there is still a long way to go in terms of exploratory efforts, financial investment and time, before we can conclude that the reported resource is indeed a mineable “reserve” and can be extracted economically. Environmental concerns also need to be addressed adequately.

If the Salal-Haimana results turn out to be positive, it will prove to be more than a ‘gold mine’ for India. In addition to the huge economic and strategic advantages, it could also trigger a much needed revamp of India’s mining policies to facilitate private participation in mineral exploration, facilitate Public-Private partnership in mining industry, forge joint ventures and permit mineral exploration companies to raise funds from the Indian stock market. In many ways, Salal-Haimana, has the potential to revolutionise mineral mining in India.

Disclaimer

The opinions expressed in this article are the author’s own and do not reflect the views of Chanakya Forum. All information provided in this article including timeliness, completeness, accuracy, suitability or validity of information referenced therein, is the sole responsibility of the author. www.chanakyaforum.com does not assume any responsibility for the same.

Chanakya Forum is now on . Click here to join our channel (@ChanakyaForum) and stay updated with the latest headlines and articles.

Important

We work round the clock to bring you the finest articles and updates from around the world. There is a team that works tirelessly to ensure that you have a seamless reading experience. But all this costs money. Please support us so that we keep doing what we do best. Happy Reading

Support Us

POST COMMENTS (0)